Our Clients Love UGRU Stocks™!

UGRU Stocks™ FAQs

You receive every alert based on the same portfolio management philosophy I used as a professional Investment Advisor. Alerts are unlimited with your subscription.

Yes, you just need the ability to make the trades in the account.

No, UGRU Stocks™ exists because I have clients that don’t have a lot of time. Once you receive an alert, you decide whether you want to make the trade. If you do, then it’s only a few minutes on your part.

Nope! All you need is a trading account.

No. This is not a get rich quick scam. I’ve used a wealth building philosophy for many years now (control what you can, manage what you can’t). UGRU Stocks™ is the “manage what you can’t” part, which is investing. But, investing rarely makes the biggest impact when building wealth (that would be financial planning). Financial planning is not a requirement to take advantage of UGRU Stocks™ but, you may want to go thru our Retirement Destinations to learn all about the “control what you can” part.

That’s up to you. When I managed portfolios as a professional, I used Charles Schwab but, there are many great platforms out there like TD Ameritrade, M-1, Robinhood, etc. For crypto, many of my clients use Coinbase and KuCoin.

I always tell my clients, I have a crystal ball but, it’s been broken for a long time. So, the downside is, well, there’s downside. This is inescapable (no matter how smart you are). The good news is perspective. If there was no downside, there wouldn’t be opportunity.

Good or bad, you will see results within the first few weeks. However, this is not something that you “try” for a few weeks. Investment performance is measured quarterly and, three quarters is usually enough to see whether a strategy is working as hoped.

No, UGRU Stocks™ is a subscription service and you can cancel anytime.

At any given time we are sending alerts on approximately 20 stocks and Crypto. Currently, we are sending alerts on:

ETFs: Vanguard S&P 500 (VOO), NASDAQ (QQQ).

Crypto: Bitcoin (BTC), Ethereum (ETH), Ripple (XRP).

Stocks: American Express (AXP), Exxon Mobile (XOM), United Health Care (UNH), Nvidia (NVDA), Advanced Microdevices (AMD), Adobe (ADBE), Alphabet – formerly Google (GOOG), Amazon (AMZN), Tesla (TSLA), Coinbase (COIN), Fortuna Silver Mines (FSM) Super Micro Computer Inc. (SMCI).

Simply put, we want volatile investments that have large trading volume and selected the Stocks and Crypto based on marketplace position with a good variety of sector coverage.

The alerts could be hours, days or weeks apart for each signal. If you had multiple holdings, you might see an alert for any given holding every day or two.

Most trading platforms offer free trading but, they may have spreads. So, depending on the platform, you could see up to 1% per trade. However, that can be as low as 0.04%.

If it helps, you can see a short write up on the best free trading platform HERE.

Not much. You can start by investing a small monthly amount of a couple hundred dollars or a small starter balance of $1,000.

That’s up to you but the more money you’re working with the more diversification you should have. For example, if you had $5,000 you might want to follow one alert. If you had $25,000 or more, you might want to follow 2-4 alerts. Again, that is up to you, just remember, diversification is not as important here because we are vigilantly trading so following more than three alerts can be a bit much.

Get your Unlimited Trade Alerts Now!

It’s simple, professional, saves time, money and there’s no experience necessary.

How Trade Trax™ Works

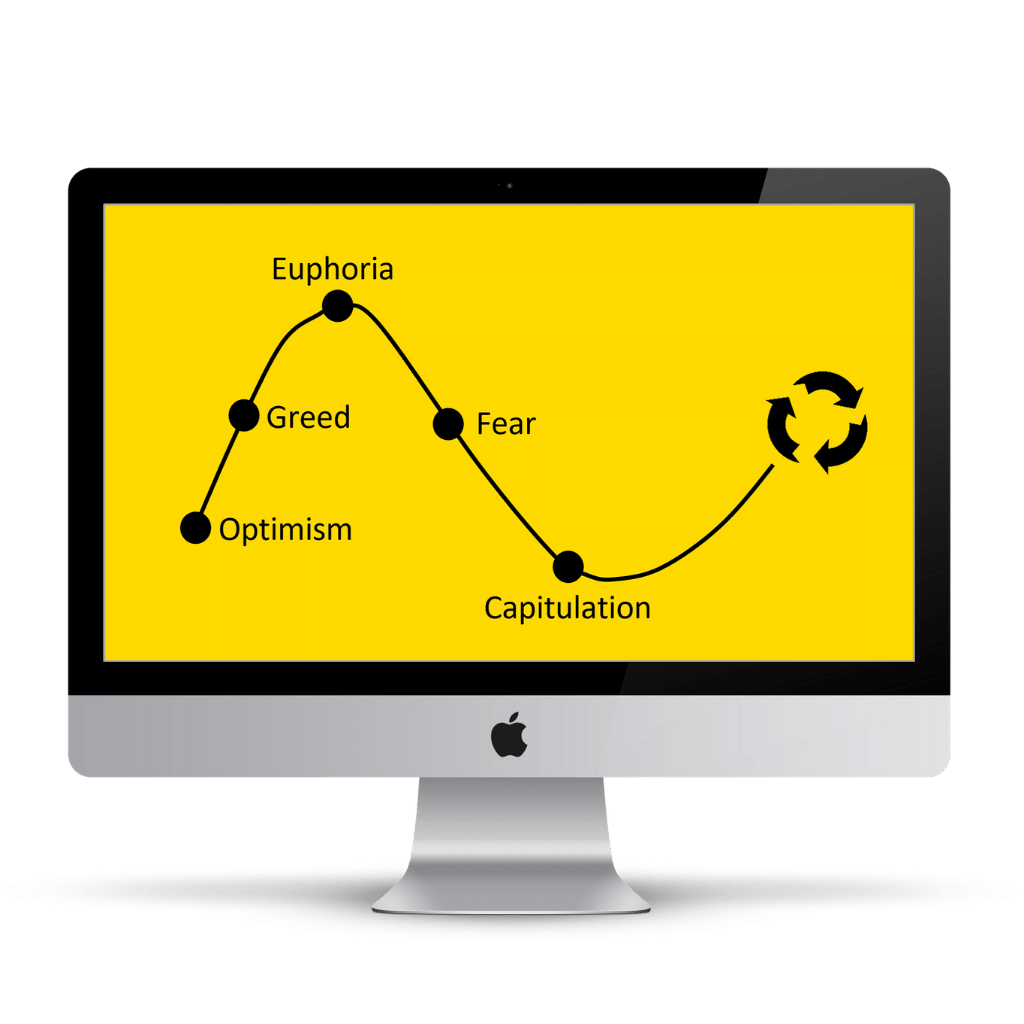

The most important part of investing is knowing when to enter and exit an investment rationally without fear or greed. For example:

- If you purchased a house, would you say you invested in real estate?

- If you bought shares of Google, would you say you invested in stocks

- If you invested in Bitcoin, would you say you invested in Crypto?

In 2022, 80,000 people lost millionaire status because they didn’t invest in probability.*

Whether you know it or not, you’re REALLY investing in probability.

The challenge is most people don’t know whether their investment has a higher probability of going up or down.

This is because their decisions are typically based on emotion where optimism is taken over by greed then eventually fear and this process is recycled over a lifetime.

*Read article here 80,000 lost millionaire status

And because of that they experience an incredibly low rate of return of somewhere between 1% and 4% average.

Inside of those emotional cycles they make their decisions typically based on three things:

- Is the chart going up/down?

- Is the brand popular?

- Do I buy the product?

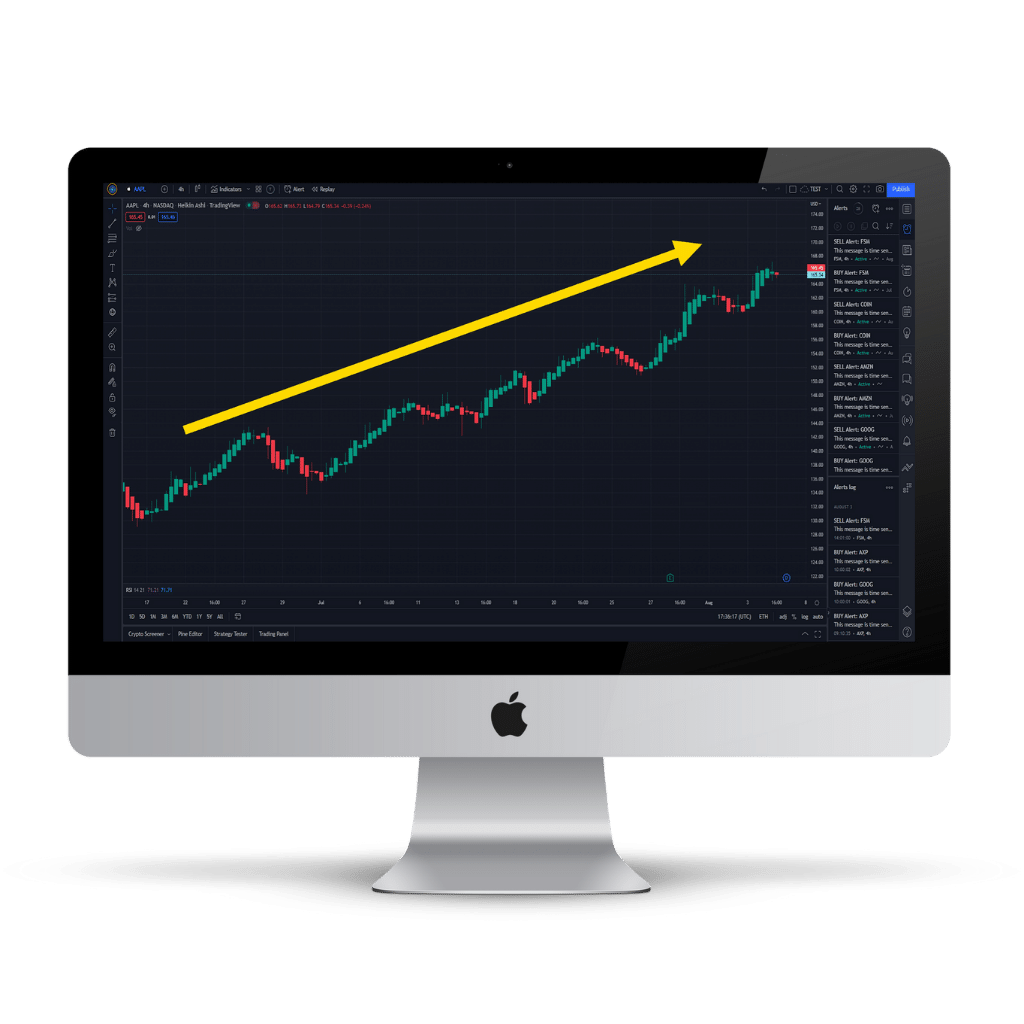

All of these make for incredibly unsuccessful investing. Take point number one, investing because the chart looks like it has a history of going up.

What they are seeing is the past and that’s like driving down the road using only your rear-view mirror.

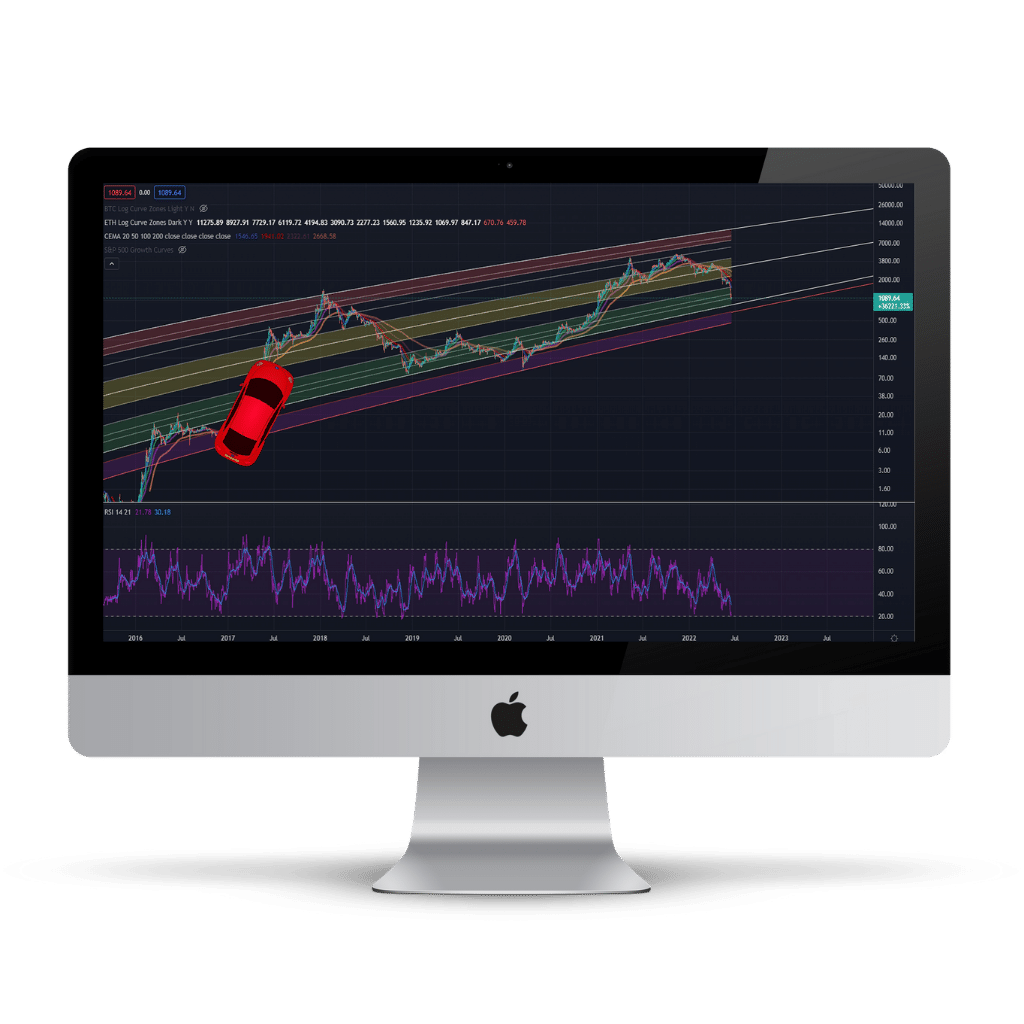

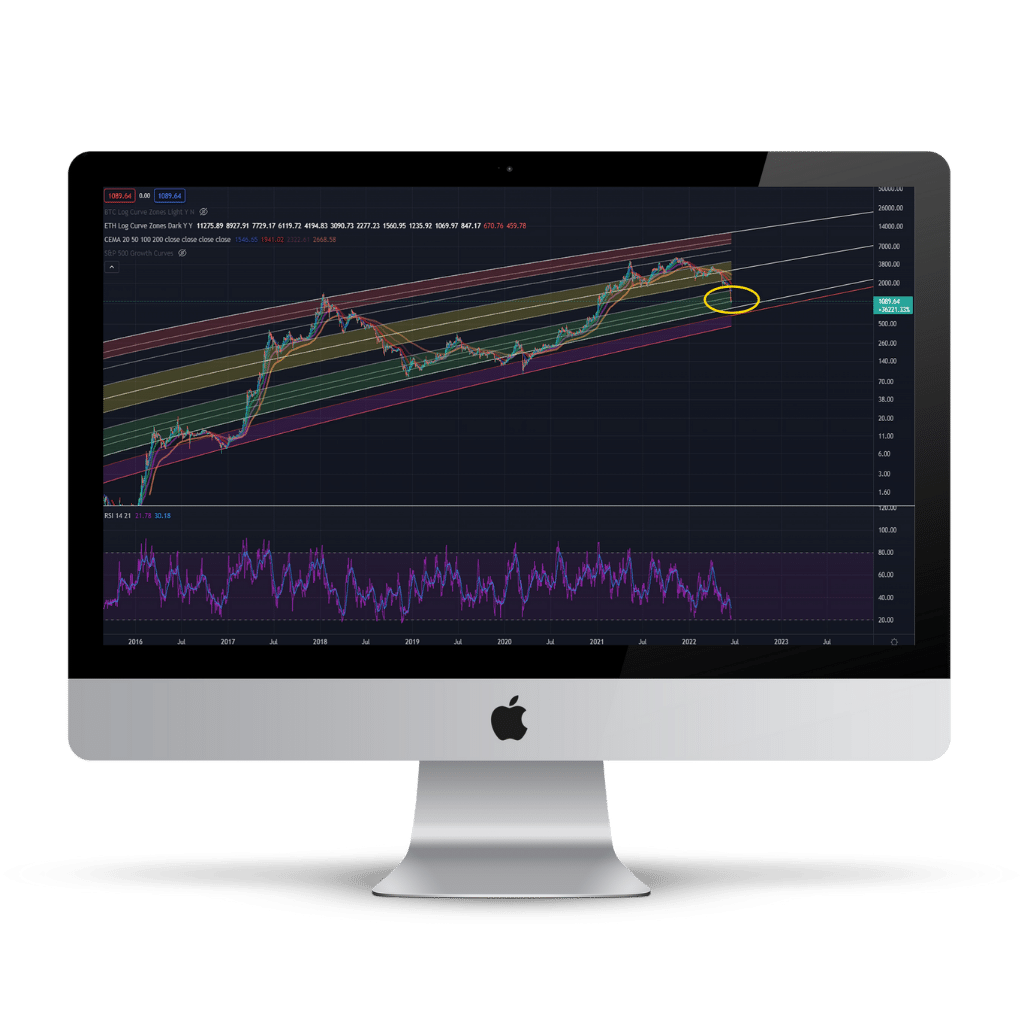

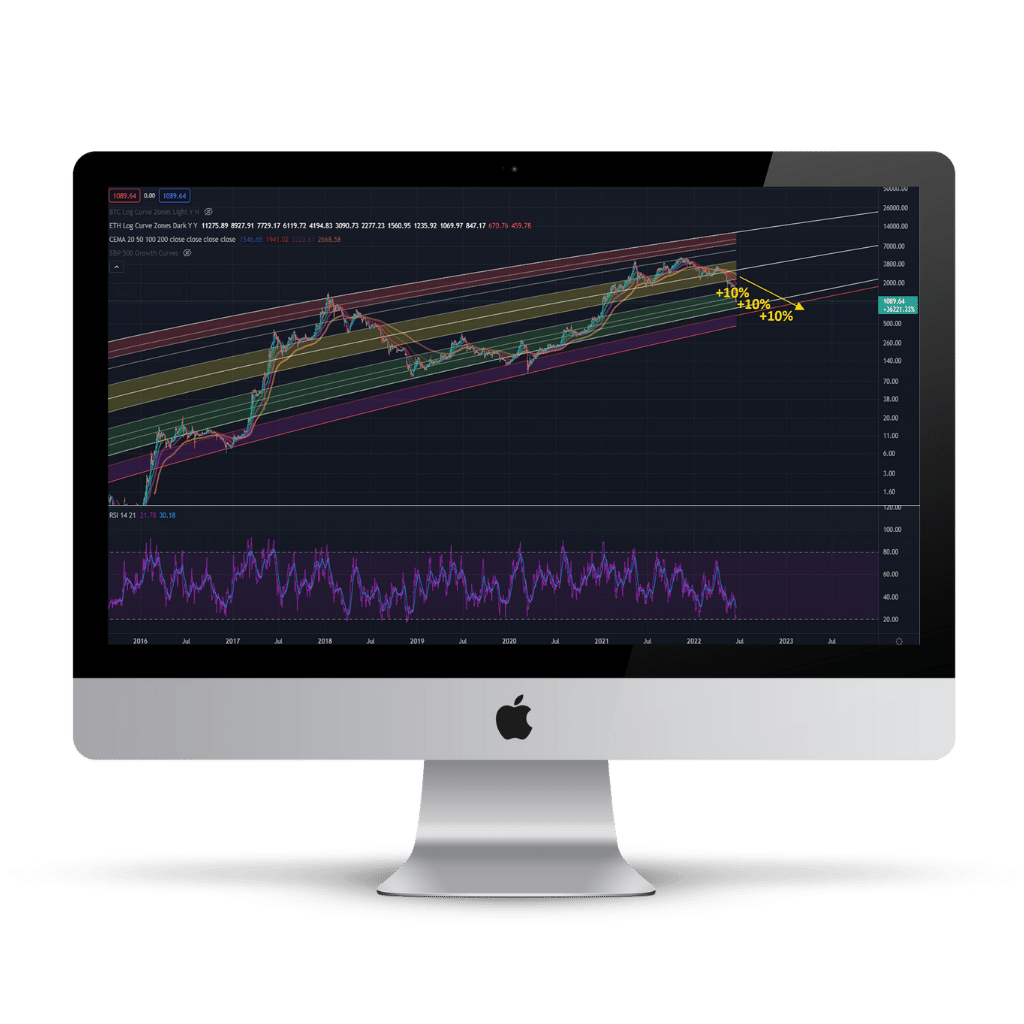

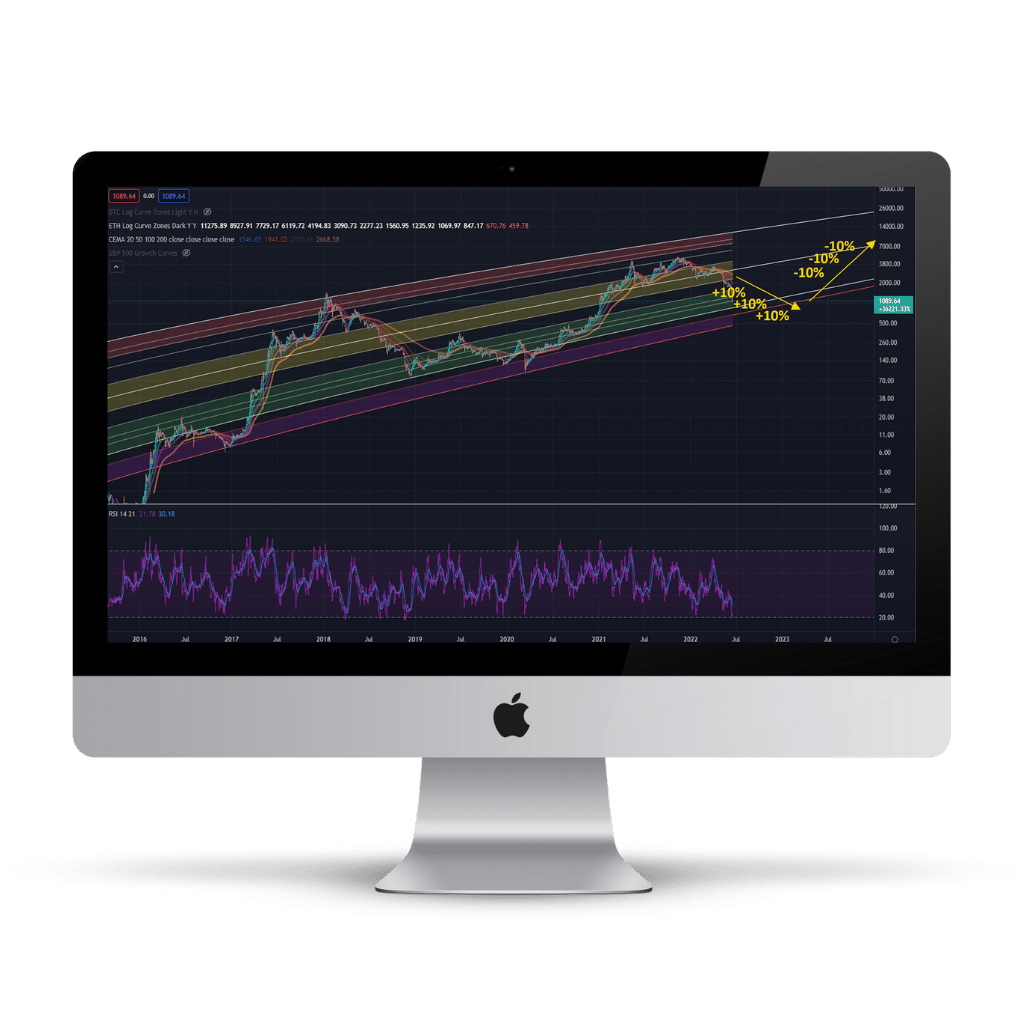

They see a chaotic heartbeat line because they’re looking at what’s called an arithmetic chart… But, if they were considering investing in an adoptive technology they might look at a logarithmic chart like below…

But, most would see this and argue it’s no more clear than the other chart… and, they’d be right unless we overlaid regression lines and my guess would be that you’d still look at the chart wrong, let’s find out…

To look at this chart the right way you should turn your head to the right. Now, imagine the yellow line is the line in the middle of the road.

If you started veering to the left, what would you do? Steer to the right, of course. And, if you were veering to the right you’d correct to the left, yes?

Now that the road is clear, it’s infinitely easier to know how we might want to invest using a mix of dollar cost averaging and our Investment Policy Statement.

So, if we had $10,000, we are a lot less likely to put all of it in right now, because this investment is only slightly oversold meaning the probability of great gains is not very high.

So we might only invest 10% of our cash per month until we reach the lower logarithmic regression line where we are in over sold territory giving us a higher probability of near future gains.

And, as the pricing starts moving up, we may start selling small amounts as we pass through the yellow line into the overbought area or upper logarithmic regression line.

This would be smart investing where you had a predefined Investment Policy Statement managing your investing behaviors so fear and greed are kept at bay.

Who is behind Trade Trax™

For twenty-five years Ken has been a top quintile advisor at Merrill Lynch and a top 1% Investment Advisor (by revenue) in the United States.

He is battle proven, calling the downturn of 2008 for his clients, and warned of the most recent that is upon us in his book, Right Where They Want You: Why You’re Not Rich and What to Do about It.

But, more than that, multiple awards showcase his dedication to the people he serves.

“I’m on a mission to equip you with the tools, resources, knowledge and actionable know-how you need to build real and lasting wealth.”

Want more Financial Tools to Skyrocket your Finances?

Upgrade to Retirement Destinations™ Membership and get our best tools for financial independence. Here’s what you Get:

Trade Trax™ Alerts

Electronic alerts with buy and sell signals so you can make the trades you want with no expensive management fees.

UGRU Budget Tool

UGRU Budget Tool helps you focus on where you want your money to go with its unique forecasting functionality.

Retirement Destinations™

Know the most optimal decisions for every financial crossroad and get results with the best financial planning software.

Thrive Coaching

Enjoy on tap knowledge with one on one quarterly financial coaching sessions for focus, mindset and accountability.

Retirement Destinations™

Tools for Financial Independence-

Trade Trax™ Alerts

-

Budget Tool

-

Financial Planning

-

Thrive Coaching

Trade Trax™ Tips and Insights

Below are some things to think about as a Trade Trax™ subscriber:

- After subscribing, join the private Trade Trax™ Telegram channel.

- Make sure you have notifications turned on for the alerts.

- The more money that’s traded the more diversification you should consider.

- Trades will lose more times than not, so be patient.

- A losing trade may have prevented deeper losses vs. choosing to hold.

- Don’t chase trades. If you’re late to the trade, simply wait for the next signal.

- Cost is important. Be sure you have the best platform for cost and execution.

- Don’t try to outsmart the signals, removing fear/greed is the point here.

- Don’t get hung up on the price, under/overvalued is what matters.

- Expect to spend one to five minutes every third day (on average) making trades.

Trade Trax™ is intended to relieve you of many burdens so you can live your life, don’t:

- Buy expensive trading software and analytics

- Trade irresponsibly with heavy margin

- Analyze why a trade did what it did

- Worry about whether we are in a bull/bear market

- Get roiled by the news

- Obsess over what your last trade is doing by the minute