it's easy!

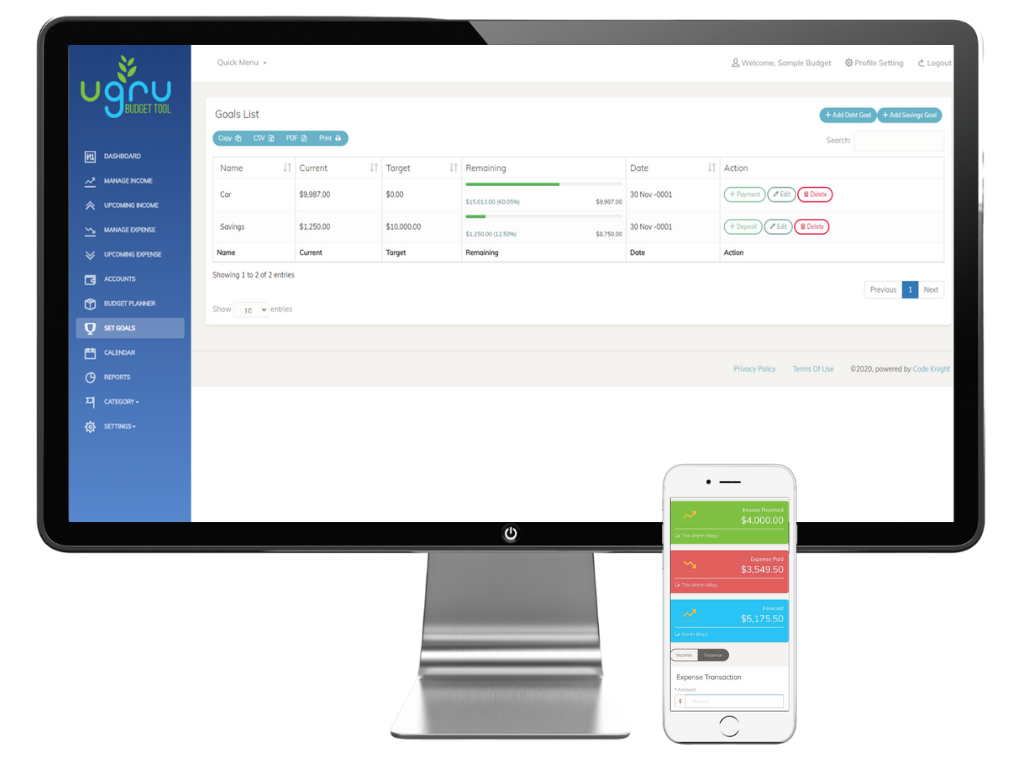

We'll show You How to Use It

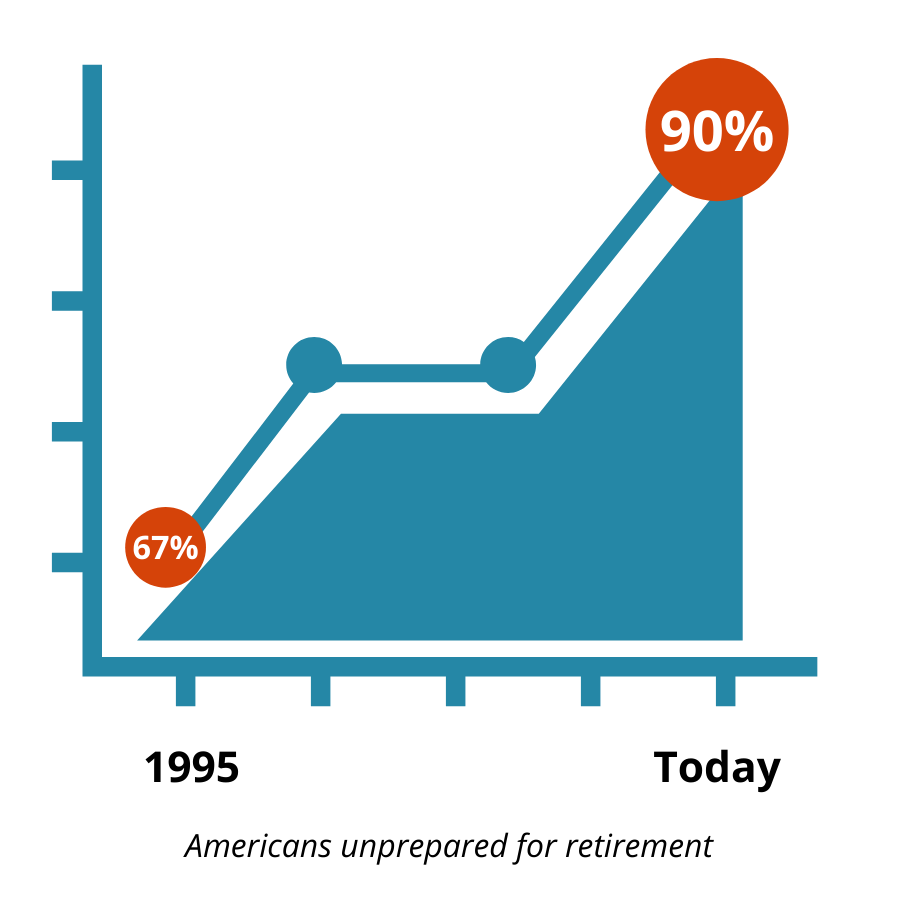

RETIREMENT IS 10+ YEARS AWAY

If you’re tired of internet confusion, bad advice, being sold, or over paying for a service that under delivers, we can help you!

RAPIDLY APPROACHING RETIREMENT

Stepping into retirement can be stressful, if not, downright terrifying. Find out how John and Laurie changed their dire situation!

COMFORTABLE IN RETIREMENT

If you had a financial plan completed, you may be disappointed to find your situation isn’t what you believe it is.