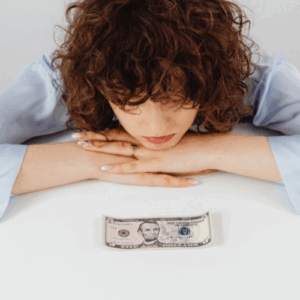

“I’ll just hold onto it. You never know when you might need it.”

Sound familiar? Whether it’s leftover lumber from a backyard shed or a $20 part from Home Depot, we’ve all said it. I’ve done it. My son’s done it. You probably have too.

But here’s what I want you to think about: That $20 decision? It’s not just a piece of hardware—it’s a financial habit. And when we stack those habits over time, they compound—for better or worse.

But here’s what I want you to think about: That $20 decision? It’s not just a piece of hardware—it’s a financial habit. And when we stack those habits over time, they compound—for better or worse.

The $20 Lesson That Could Be Worth Thousands

Let’s do some simple math:

One item kept per week “just in case” = $20/week

That’s $1,040 a year

Left to sit in the garage, it collects dust and may become obsolete

But if that money were invested instead at 9%?

After 20 years, it grows to nearly $5,000

That’s the result of just one year of small weekly decisions. Now imagine the impact over a decade.

Why “Just In Case” Is Costing You

Why “Just In Case” Is Costing You

We’ve been conditioned to think:

“Be conservative.”

“Don’t return it—you might need it later.”

“Better to have it than not.”

But there’s a hidden cost to hoarding. The real question is:

What’s the future value of that ‘conservative’ decision?

Letting Go Isn’t Loss—It’s Leverage

Here’s the takeaway: Loosen your grip. The tighter you cling to “just in case,” the more you close yourself off to real growth. Letting go is what allows growth to happen. It’s not about being careless—it’s about being intentional.

Ready to Build Wealth with Smarter Habits?

Take the Retirement Checkup now: https://ugrucoaching.com/