Retirement Destinations™ The Best Financial Planning Software

Create high quality and fully comprehensive financial plans in half the time with the best in class financial planning.

Create high quality and fully comprehensive financial plans in half the time with the best in class financial planning.

Retirement Destinations™ has all the features seen in the most popular financial planning applications, plus some found nowhere else.

Market Dynamics replaces the “static” returns commonly used by advisors when constructing financial plans.

Easy to use calculators that analyze how common planning strategies will impact a plan.

A hybrid investment strategy that couples an aggressive market account with a fixed indexed annuity.

Determine the optimal income distribution order of your investment and bank accounts based on taxes, fees, and expected rate of return with just ONE click.

Based on the variables input about the primary residence of the client, the user can test the economic value of a reverse mortgage.

Test any account to see the gain or loss of exercising a guaranteed income benefit - NOT to be confused with simple annuitization which is also testable in the calculator.

Auto-generate an editable full overview word document from pre-built paragraphs based on each of your plan recommendations.

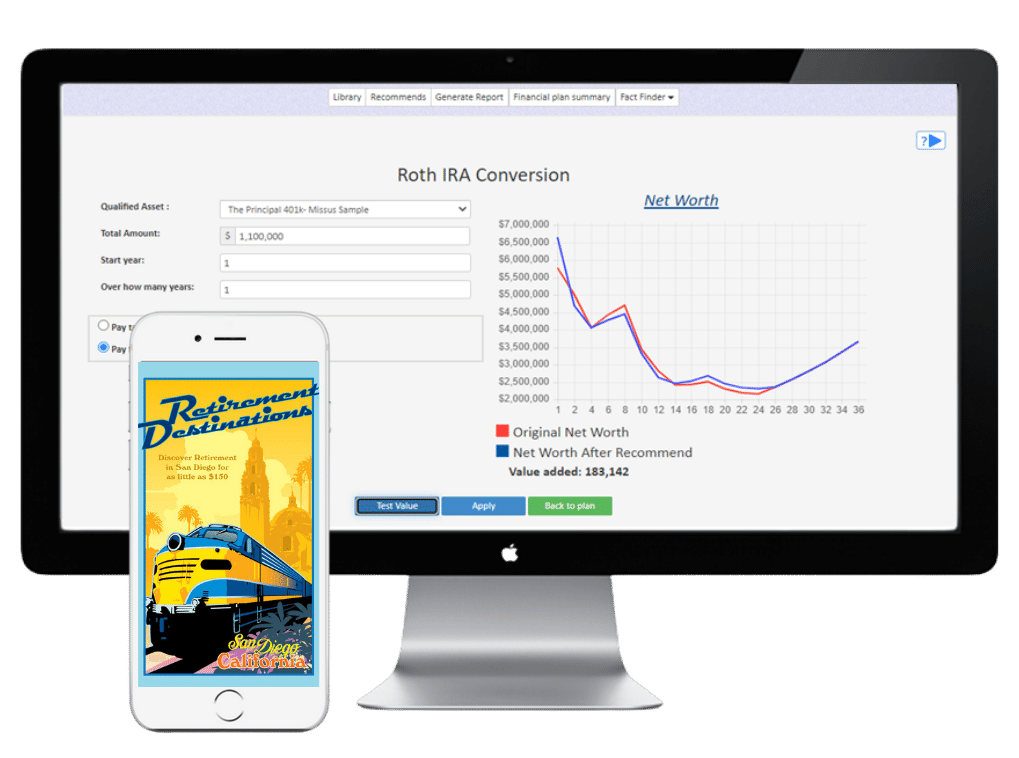

Test any qualified account using partial or full values for the economic benefit of performing a Roth conversion.

A convenient auto-generated spreadsheet report that easily directs staff to prep all paperwork based on your plan recommendations.

Retirement Destinations™ financial planning software, provides goal based planning, needs analysis, cash flow planning, estate planning, advanced planning, investment planning, and retirement income planning. You can also model existing holistic financial pictures and test multiple scenarios using unlimited plan iterations.

Allows you to plan for a specific monetary goal over a certain number of years.

Forecasts cash inflows and outflows over several years.

Enables you to create financial plans that incorporates fine details.

Accounts for all recommendations made in the process of building the financial plan and builds a cover letter for the plan by auto populating template paragraphs that point out the recommendation, why the recommendation was made and the calculated value of that recommendation.

These are easy to use calculators for testing and analyzing how common planning strategies will holistically impact a financial plan. Once the value of the strategy has been optimized, you can implement it with a single click:

Helps determine your client’s monetary needs through the interview process.

Allows you to plan tax-advantaged and protective strategies for the estate to benefit your client’s heirs.

Planning the risk levels of income providing asset accounts, the optimal distribution method and order, and comfortably ensuring a client’s retirement income.

The Decision Center financial calculators integrate all solutions holistically in the plan so you can create high quality professional financial plans in half the time with the best in class financial planning.

Want to Learn more?

Use custom inflation rates for each category of income/expense, take advantage of the Decision Center calculators, and download a fact finder with a single click.

Create fully comprehensive financial plans at a FRACTION of the cost of the competitive alternatives and cut plan creation in half.